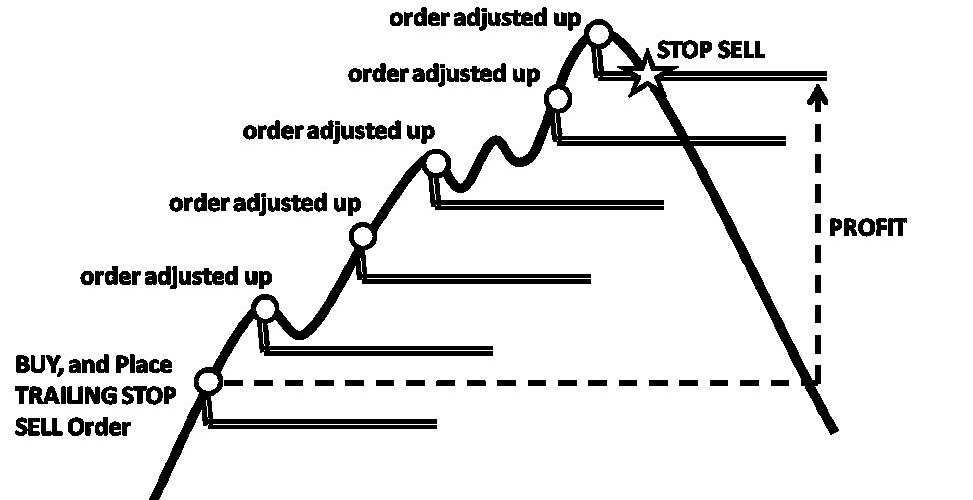

What Is A Trailing Order . As the market price rises, the. A stop becomes a market or limit order when a stock hits a predetermined target. a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. A trailing stop order helps traders limit their losses and protect their gains when the market swings. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? — what is a trailing stop order? First, we need to define stop orders.

from www.stephenralph.com

First, we need to define stop orders. A trailing stop order helps traders limit their losses and protect their gains when the market swings. As the market price rises, the. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. — what is a trailing stop order? A stop becomes a market or limit order when a stock hits a predetermined target. — what is a trailing stop order?

Using Trailing Stop Orders to Maximize Profits and Minimize Risks » Day

What Is A Trailing Order a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. As the market price rises, the. a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. First, we need to define stop orders. A stop becomes a market or limit order when a stock hits a predetermined target. A trailing stop order helps traders limit their losses and protect their gains when the market swings. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? — what is a trailing stop order?

From investguiding.com

Trailing StopLoss Order Strategies Explained (2023) What Is A Trailing Order A trailing stop order helps traders limit their losses and protect their gains when the market swings. A stop becomes a market or limit order when a stock hits a predetermined target. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? —. What Is A Trailing Order.

From walletinvestor.com

What is a trailing stop order and how is it used in day trading What Is A Trailing Order A stop becomes a market or limit order when a stock hits a predetermined target. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? As the market price rises, the. First, we need to define stop orders. A trailing stop order helps traders. What Is A Trailing Order.

From pluto.ghost.io

What Is a Trailing Stop Order in Trading? What Is It & Examples What Is A Trailing Order a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? A trailing stop order helps traders limit their losses and protect their gains when the market swings. A stop becomes a market or limit order when a stock hits a predetermined target. —. What Is A Trailing Order.

From tradersunion.com

What Is a Trailing Stop Order? Traders Union What Is A Trailing Order a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. — what is a trailing stop order? — what is a trailing stop order? First, we need to define stop orders. A stop becomes a market or limit order. What Is A Trailing Order.

From forextraders.guide

Different Types of Forex Orders Explained ForexTraders'Guide What Is A Trailing Order As the market price rises, the. — what is a trailing stop order? — what is a trailing stop order? First, we need to define stop orders. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. a sell trailing stop order sets the stop price at a fixed. What Is A Trailing Order.

From thetradinganalyst.com

Types of Options Orders Explained (2022) Easy Examples What Is A Trailing Order — what is a trailing stop order? First, we need to define stop orders. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially. What Is A Trailing Order.

From www.youtube.com

How to Use a Trailing Stop Loss (Order Types Explained) YouTube What Is A Trailing Order a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. — what is a trailing stop order? a trailing stop loss order adjusts the stop price at a fixed percent or number of points. A stop becomes a market or limit order when a stock. What Is A Trailing Order.

From mt4gadgets.com

Trailing Stop Explained MT4Gadgets What Is A Trailing Order a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. As the market price rises, the. A stop. What Is A Trailing Order.

From tradersunion.com

What Is a Trailing Stop Order? Traders Union What Is A Trailing Order — what is a trailing stop order? First, we need to define stop orders. A trailing stop order helps traders limit their losses and protect their gains when the market swings. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. a sell trailing stop order sets the stop price. What Is A Trailing Order.

From www.quantifiedstrategies.com

What is a Trailing Stop Order? Quantified Strategies What Is A Trailing Order First, we need to define stop orders. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing. What Is A Trailing Order.

From trailingcrypto.medium.com

An Introductory Guide to Trailing Stop, Trailing StopLoss and Trailing What Is A Trailing Order As the market price rises, the. — what is a trailing stop order? First, we need to define stop orders. — what is a trailing stop order? a trailing stop loss order adjusts the stop price at a fixed percent or number of points. a sell trailing stop order sets the stop price at a fixed. What Is A Trailing Order.

From ensiforex.com

Trailing Stop Order and How to Use It EnsiForex What Is A Trailing Order a trailing stop loss order adjusts the stop price at a fixed percent or number of points. First, we need to define stop orders. — what is a trailing stop order? A stop becomes a market or limit order when a stock hits a predetermined target. A trailing stop order helps traders limit their losses and protect their. What Is A Trailing Order.

From binary.mxzim.com

How To Set Trailing Stop Loss What Is A Trailing Order As the market price rises, the. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. a trailing stop loss order adjusts the stop price at a fixed percent or number of points. — what is a trailing stop order? A trailing stop order helps. What Is A Trailing Order.

From www.parkingpips.com

Forex trading order types What Is A Trailing Order a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. As the market price rises, the. A stop becomes a market or limit order when a stock hits a predetermined target. a trailing stop order is a variation on a standard stop order that can help. What Is A Trailing Order.

From stockstotrade.com

Trailing Stop Order What Is It & How to Properly Use It What Is A Trailing Order a trailing stop loss order adjusts the stop price at a fixed percent or number of points. As the market price rises, the. — what is a trailing stop order? a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their. What Is A Trailing Order.

From inosocial.com

What is a trailing stop order? (Full guide) InoSocial What Is A Trailing Order A trailing stop order helps traders limit their losses and protect their gains when the market swings. a trailing stop order is a variation on a standard stop order that can help stock traders who want to potentially follow the trend while managing their exit. A stop becomes a market or limit order when a stock hits a predetermined. What Is A Trailing Order.

From www.youtube.com

How To Place A Trailing StopLoss Order Order Types YouTube What Is A Trailing Order A trailing stop order helps traders limit their losses and protect their gains when the market swings. As the market price rises, the. A stop becomes a market or limit order when a stock hits a predetermined target. — what is a trailing stop order? a trailing stop order is a variation on a standard stop order that. What Is A Trailing Order.

From www.carboncollective.co

Trailing Returns Definition, Calculation, & How They Work What Is A Trailing Order First, we need to define stop orders. A trailing stop order helps traders limit their losses and protect their gains when the market swings. a sell trailing stop order sets the stop price at a fixed amount below the market price with an attached trailing amount. — what is a trailing stop order? A stop becomes a market. What Is A Trailing Order.